The Ultimate Guide to Finding a Startup Job

I originally wrote this guide in 2020 when tech markets were at an all-time high and venture-backed startup jobs were among the most desirable. While things have cooled off considerably since then, I continue to believe that joining a startup is among the very best career options for young people in 2024. Jobs at high-growth startups offer some of the best opportunities to learn new skills, build your network, and create long-term wealth. Before we jump in, a quick summary of what has changed in the past few years and the job market outlook for 2025:

- Startup jobs are much harder to get – given the market environment, startups are optimizing for preserving cash and extending runway, which means they are much more selective than before and less likely to take a bet on hiring young people without a ton of experience. This doesn’t mean it’s impossible.

- The best bet is to look for companies that have raised in the past 6 months (2H 2022) – these are the companies that had the metrics and story to raise in a downturn, they have the cash to hire new talent, and they have the runway (likely 2+ years) to weather whatever happens in the markets. Most importantly, these companies have fairly priced valuations, making your equity packages more likely to be worth something down the line.

- Compensation remains largely unchanged – despite what many are saying, the data indicates that overall compensation packages (in terms of cash and equity), remain competitive for young people and have not taken hit (see data below). In many cases, equity packages are higher than before in order to accommodate for 2020/2021 overvaluation. Only at senior levels (staff engineer/director/VP) are cash compensation packages taking a hit.

- Crypto is out, generative AI is in – as is expected with startups, certain areas are heating up and others are cooling. My general advice is don’t chase hype cycles and follow your passions. I’m a believer that generative AI will be game-changing, but many companies building here are certainly overhyped/overvalued. Web3/crypto may appear to be dying, but now may also be the time when the category-defining businesses are built and the true believers persevere. I continue to believe that the unsexy, large, fragmented industries continue to be exciting and that cloud software is still in its earliest innings. The updated list of “hot companies” below will hopefully reflect these changes and more.

Who are you?

If you stumbled upon this guide, my guess is you’re either a current college student or under 5 years out of college. You might work at a large tech company, in financial services (IB, PE, etc.) or consulting. You’re considering joining a high-growth startup and are excited about this potential career path, but you’re not really sure how to approach the process. If so, this guide is for you.

Who am I and why did I write this?

I’m a venture capital investor, startup enthusiast, and failed entrepreneur among other things. I’ve spent the past several years investing in and advising startups, most notably on hiring at the junior levels. I am a very big believer that talented young people should be spending their 20s building cool stuff at startups, not stuck in the rat race of big tech/banking. However, several conversations with friends recently have highlighted to me how opaque the process is, which makes taking the leap all the more difficult. Moreover, I’ve seen many friends get screwed by lowball offers or confusing equity packages. Despite the many resources on the Internet, I have yet to see something that offers useful tips, cuts out the fluff and provides clear, opinionated, actionable advice. I hope this guide can fill in the gaps.

What are you looking for?

I think the very first question young people should be asking themselves as they take the plunge into startup land is what they are looking for in their next opportunity. The experience of working at a startup is unique and not for everybody. It tends to be fast-paced and entrepreneurial, often bordering on chaotic. You will have to wear a lot of hats and will likely work longer hours than a traditional big company while getting paid less. So think deeply about what you really want. If the answer is:

Getting rich – The startup world is not for you and you probably want to stay in your current gig. Joining a startup as a non-founding employee is rarely the best risk-adjusted path to wealth. The vast majority of startups fail and even with a successful exit, early employees will only get outsized returns if the company has a multi-billion dollar exit, which is exceedingly rare. The reality is that the risk-reward tradeoff is almost never worth it for startup employees, whether they join early or later. Only founders are adequately compensated for the risk they are taking. So if your goal is to get rich, either start a company or stay at Google/Goldman.

Chasing “clout” – If your goal is to build your brand/network/resume and preserve your optionality, join a fast-growing growth-stage (series B or later) company and stay there through an exit (IPO or acquisition). I have noticed that being an “early” employee at an already-successful company gives people an undeserved amount of credit. E.g. if you had joined OpenAI a few years ago, a time when they were already well-funded and growing fast with hundreds of employees, you would now be considered a “genius.” This isn’t necessarily the path that optimizes for wealth or learning, but it most definitely will give you a gold star on your resume and make it very easy to join another company or raise money for your own.

Solving a problem – If you are mission-driven, joining a startup can be one of the more interesting and high-impact things you can do. Figure out if there is a problem in the world you have a deep desire to solve (e.g, climate change, access to affordable mental health), and see if there is a startup that is working to solve it. This type of alignment will not only make your search easier, but will allow you to really thrive in a new role.

Learning – Similarly, your search will be much easier if there are specific skills you aim to gain or new areas of technology/verticals you want to learn about (such as generative AI or construction tech). If you’re an engineer, maybe there are certain types of technologies or languages you want to work on.

Building a network – Perhaps the most underrated aspect of joining a startup is the strong bonds you will form from being in the trenches with your teammates. If all goes well (but likely even if not), the team you join will be your lifelong friends, mentors, future investors, cofounders, etc. If your primary goal is building such a network, all you should be optimizing for is joining a group of exceptional people who you respect deeply; the earlier stage, the better (think seed stage or even earlier).

Becoming an entrepreneur – Joining a startup is the best thing you can do if your long-term goal is to be an entrepreneur. If this is your goal, the earlier-stage company you join, the better (think seed or series A stage). Joining a company early in its evolution will expose you to all the ins and outs of building a business from the ground up, making you all the more prepared to strike out on your own. Arguably the most difficult part of building a startup is finding product-market fit; joining at around the time a startup is going through this process will give you invaluable perspective on doing it yourself.

If you’ve read this and aren’t quite sure where you fall, my general advice is: join a growth-stage startup!

How do you find an interesting company?

Once you’ve figured out what you’re looking for, the next step is to find companies that may be interesting to join. There is no magic formula here, but here are a few good places to look:

LinkedIn headcount growth – Sign up for a LinkedIn premium or Sales Navigator free trial and sort companies by those with the fastest growing headcount (ideally 100%+ YoY). In lieu of financial metrics, the headcount growth of startups is one of the best lagging indicators that a business is performing well. VCs use this hack all the time to search for companies to fund at the growth stage. This tip will only work for companies with 30+ employees so it’s ideal if you want to join a well-funded, growth-stage company (think series B and beyond).

Portfolios of top VC firms – An easy way to search for companies that are interesting is to look at the portfolios of top VC firms (Sequoia, Benchmark, Index, Accel, Bessemer, a16z, Lightspeed, etc.). Keep in mind that the majority of these companies will fail, that’s how VC portfolio construction works! But these lists are a helpful place to start your search. Many of these firms also have job boards on their web sites that aggregate all the open postings across portfolio companies (e.g. the “careers” tab on the Two Sigma Ventures website).

Talent partners at VC firms – Going one level deeper, most of the larger VC firms have Talent Partners whose sole job is to help portfolio companies with recruiting (e.g. Peter Clarke at Accel, Glen Evans at Greylock or Davey Nickels at IVP). You can find them easily on any VC team page. Get in touch with these people. Rather than culling through the portfolio list/job board yourself, these people may be able to tell you which companies are growing fastest and help you target your search. Cold email them (and follow up!); they can be an excellent resource.

Lists/boards/Google searching – Don’t underestimate the power of a simple Google search or well-trodden startup job boards (Y Combinator Jobs, AngelList, Hacker News, BuiltIn). There is frequently interesting content published under lists like “most interesting healthcare startups” or “fastest growing developer platforms.” Additionally, widely published rankings could give you a sense of which companies and products are doing well or not – e.g. Apple/Android app store rankings, the Alexa ranking of top Internet URLs, and projects on Github associated with a company among others. Be data driven whenever possible.

Your network – This is fairly self explanatory, but your network can be a valuable resource. If somebody you think highly of is starting or joining a company (particularly a former manager or coworker with whom you’ve enjoyed working with before) it could be an interesting opportunity.

Headhunters – Similar to Talent Partners at VC firms, headhunters from search firms are often hired by startups to help them recruit top talent. Many of you may have heard from these firms (True Search, Opus Search, IvyScale, etc.). Proactively reaching out to folks on these teams is another great way to figure out what companies are interesting and also to get free career/resume advice.

If you’re fairly indifferent as to the type of company to join (stage, sector, geography) and you just want to maximize your learning/financial outcome, the best advice I’ve heard is to find the arbitrage opportunities. What this means in practice is to look for companies that are particularly unsexy or overlooked: b2b companies instead of consumer, those operating in niche areas of technology/verticals (SMB software, cybersecurity), those operating outside of traditional geographies like Silicon Valley.

Not only will these jobs be easier to get (fewer applicants/name brand awareness), but the data suggests these types of companies are far more likely to succeed. The list of unicorns ($1b+ valuation private startups) is largely b2b software companies operating in very unsexy realms. This list is also now more global than ever! In the post-COVID age where remote work is becoming a norm rather than the exception, there also exists an arbitrage opportunity with companies that are headquartered outside of the US but may be willing to hire here.

What signs do you look for and what questions should you ask?

Core business metrics – All too often, candidates don’t ask the most important questions of the startups they are recruiting with – “do you have product/market fit?” and “what are your financials?.” If a startup is serious about hiring you, they should be transparent with you about these metrics. Generally speaking, for a b2b software company, really strong product-market fit is evident when they’re at or above $1m of ARR (annual recurring revenue) growing at 150% YoY (or ~8% MoM). This is obviously just a rough heuristic, but anything far below this (especially in terms of growth) is a red flag. For a consumer business, you’ll want to see strong (100%+ YoY), organic growth in whatever their core success metric is (GMV, DAU, MAU, etc.) and some clear path to monetization. Think like a VC and ask all the tough questions; you want to be fully informed before making a leap.

LinkedIn headcount growth – In lieu of having the financial metrics of the business, as discussed above, the headcount growth chart on LinkedIn will give you a rough sense for how the business is performing. This data is slightly skewed recently given recent layoffs and hiring freezes, but headcount should ideally be growing at 50%+ over the past 2 years. It is now easy to identify companies with recent layoffs, given they will have negative headcount in the past 6 months. These are companies worth avoiding.

The team – Without a doubt, the team is the most important thing to evaluate when joining a startup, especially an early-stage company. You ideally want to work for people you respect deeply who can be friends and mentors to you for the rest of your career. Though it goes against the popular narrative, the best founders are typically those with many years of experience (think folks in their 30s or 40s with years of industry experience or multiple entrepreneurial stints under their belt). This is especially true in the b2b software world – if a founder is solving a very niche problem (say, building software for the construction industry), you want them to have deep empathy with the problem they are solving (years managing a construction business, for example). Ignore things like where people went to school or whether they worked for “blue chip” professional services firms like McKinsey – this means absolutely nothing in whether they can build a successful business.

Fundraising history – Fundraising history will give you good signals on how a business is performing. Be sure to ask the folks at the company for detailed information on the fundraising history of the business (how much was raised, when, by whom, at what valuation). Many companies won’t announce funding rounds until much later so publicly available information is often misleading. This information is critical and you have a right to know it (especially valuation information when evaluating your total compensation package). Generally speaking, it’s a good sign when a company has raised money recently (within the last 6-12 months), when the round sizes are increasing over time (implies the company is growing), and when the firms/people on the cap table are reputable. Some red flags include not raising money for a while, raising rounds where the amounts are getting smaller or staying the same (this is called a bridge round and often implies the company is struggling to find product-market fit).

How do you get your foot in the door?

Cold emails – Cold emails are your best friend. Be concise and pleasantly persistent and entrepreneurs will be impressed. They have to send cold emails all day to prospective customers, employees and funders so they will most definitely understand and appreciate the hustle. Use tools like hunter.io to find people’s email addresses and if you can’t find it, just guess. {firstname}@{companyname.com} often will do the trick!

Even if a company doesn’t have an open role that’s a fit for you, reach out anyways. If you push hard enough and prove you can add value, the best CEOs will make room for you.

Your network – Your network can be valuable for getting warm introductions when cold emails don’t work.

Headhunters/talent partners – As described above, if a company lead comes through a headhunter or VC Talent Partner, they will be your best introduction to the company.

LinkedIn – LinkedIn today has become the default manner by which startups, headhunters, and others will look you up. Many won’t even ask for a resume! Make sure you have a comprehensive profile that accurately reflects your experiences, skills, and interests.

Interviews – I purposefully have not included any specific comments here as the interview process for startups varies widely depending on an individual company culture and the specific role you’re looking for. If you’re an experienced engineer or PM, the traditional interview processes you’re used to at large tech companies will apply. Resources like Cracking the Coding Interview and Cracking the PM Interview will be helpful. The one thing I will stress is that interviews, especially at startups, are mutual selection processes. You should be convincing your interviewer that you’re a good culture fit and deeply aligned with the startup’s mission and you should be evaluating the company as well to see if it’s a culture fit for you. This is all the more important at smaller companies where culture will ultimately make or break your experience. Your chance to do this will be at the end of interviews when you’re asked what questions you have. Ask things like, “How are decisions made?” and “How do you view my career and role progression?”

How should you expect to be compensated?

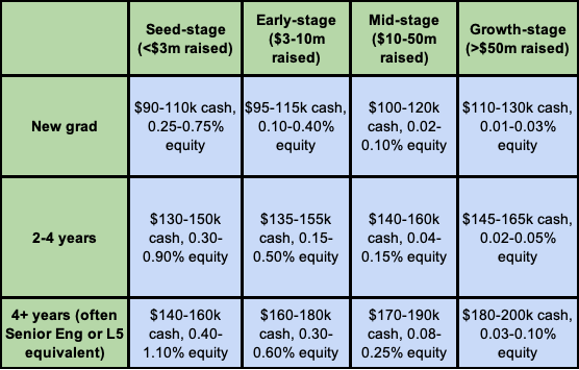

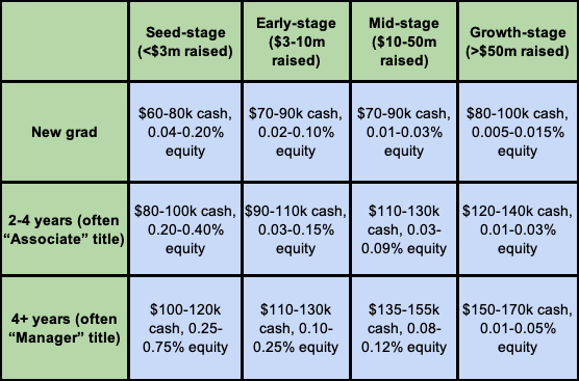

I got this data by surveying several friends who work at startups in addition to pulling data from Pave a VC-specific salary database and some search firms. Think of this as the 50th percentile data for late 2023/early 2024. This data is likely more representative of jobs in larger markets (SF/NYC). I tried to be as specific as possible without inundating you with granular data. I’ve used funding amount as a primary filter because this is most clearly correlated with how much a startup can pay you (as opposed to something like “stage” which can mean very different things to different startups). I’ve provided data for new grads to those with 4+ years of experience given this is the demographic of the majority of readers. Also of note is that startup salaries/equity don’t really increase much beyond this unless you join as an exec (VP or C-suite). Finally, the data is broadly divided into technical and non-technical roles. The disparity between subroles is fairly minimal.

Technical roles (Software Engineering, Product Management, Data Science)

Non-technical roles (Chief of Staff, Business Operations, Strategy, Business Development, Marketing, Finance)

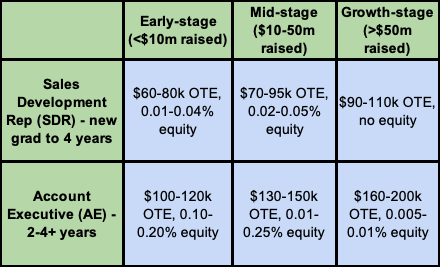

Sales roles:

While sales roles haven’t been discussed as deeply, they can be an amazing launching pad for a career in tech. Generally speaking, sales people can be divided into: SDRs (sales development representatives) who prospect for new customers and set up meetings and AEs (account executives) who demo and close customers. Sales compensation is heavily weighted towards incentive-based bonuses. Compensation numbers will be given to you in the form of on-target earnings (OTE), which is expected total cash compensation if you meet your performance goals. The typical composition of OTE is 50% base salary and 50% bonus. Most startups won’t hire SDRs/AEs until after the series A (post product-market fit). At early-stage companies, a little bit of equity compensation is included, but it is generally far less than other startup roles and more weighted towards cash comp. There exists a lot of variability among startup SDR/AE compensation based on the contract sizes the company targets, whether you’re focused on SMB or enterprise deals, and a myriad of other factors. Again, consider this the 50th percentile data:

Some general tips:

Cash is king – startups today will likely offer you multiple compensation options with different mixes of cash and equity (e.g high cash, low equity or low cash, higher equity). Generally speaking, for young people, my advice is to take the highest cash compensation offer. A few reasons why. First, think of your equity as a lottery ticket. It very likely is worth nothing. In the vast majority of outcomes, you’re better off taking the cash. More importantly, once you’re inside the machine and have a better sense of how the business is performing, there are always chances to increase your equity. Every time the company raises a new round of funding, they expand the Employee Stock Option Pool (ESOP). You can always negotiate more equity over time through a grant refresh, especially if you get promoted and are a high performer.

Use leverage – startup compensation can vary quite a bit. There are no standard rules around comp like there are at large corporations. This means that if you have leverage and a startup really wants you, you can be aggressive and get a great deal. Try and get multiple competing offers. If your previous employer had better health coverage or other non-cash benefits, you can use this to increase cash compensation.

Understand the full dollar value of your equity – one of the biggest mistakes I see young people make is not fully understanding the value of their equity. You should aim to understand the full dollar value of your options and how much ownership of the company this represents. This is fairly easy to compute. For example, let’s say your offer is for 50000 shares, at a strike price of $0.80 and a price of $5.00 at the last round, which was a series C at a $500m post-money valuation.

- The strike price – the price at which you will exercise, or purchase the options. In this case, $0.80. You will need to eventually pay $0.80 x 50000 or $40000 to purchase your shares!

- The current price or paper value – typically the price at the latest round of financing. In this case, $5.00 per share.

- The difference between these two numbers multiplied by your shares is the value of your equity on paper today: ($5.00 – $0.80) x 50000 = $210,000.

- Dividing this number by the post-money valuation of the last financing will give you a rough sense for how much of the business you personally own: $210,000 / $500,000,000 = approximately 0.042% ownership. Let’s say this is for a Business Operations Manager position and this company is at growth-stage – the table above would indicate this is a fair offer.

Run a few simulations on your own to understand how much your shares are worth in various exit scenarios – e.g. at a $500m exit, $1b exit, $10b exit, etc. TLDROptions may be a helpful tool. Note that you will get diluted heavily if the company raises more capital in the future (think 10-30% depending on stage). These exercises are typically very sobering (show how unlikely it is you’ll get rich) but are critical to understanding your equity. Keep in mind that your shares typically vest over 4 or 5 years with a 1-year cliff – if you leave before 1 year you lose all your equity and you need to stay 4 or 5 years to “earn” the full value of your shares. I’ve also found Levels.fyi to be the best source of data on total compensation packages at public and growth-stage tech companies if you need more points of comparison.

Join right before an up-round – if possible, join a startup right before they raise a new round of funding. Your stock options will be struck at the 409a valuation of the previous year or funding round but will be worth significantly more on paper soon after. This is an easy hack for getting more equity than you deserve. Startups typically raise capital in 12-18 month cycles so if you join 9-12 months after a fundraise you’re in a good position. Additionally, you can just ask management about the fundraising plans and time things accordingly.

Early exercising – I am often asked by candidates whether they should early exercise their stock options in order to reap the potential long-term tax benefits. The answer depends mostly on your conviction in the company and your willingness to lose the tens of thousands of dollars it will likely cost. My general advice is don’t do it or only early exercise a small portion of your shares if that’s a possibility. As discussed above, your equity will likely be worth nothing making the expected value of this investment negative.

If I were to join a startup now at different stages, where would I go?

As of August, 2024, here are some of the companies I am most excited about, filtered by stage including links to their dedicated job boards. This list is of course biased in that it includes several of my portfolio companies and angel investments. However, these are also the companies I have the most information about. Taking my own advice from above, this list skews highly towards b2b software companies operating in unsexy areas 🙂 I’ve also added an “impact” section focused on particularly mission-driven companies that also have sustainable business models.

Seed:

- Avenue – observability tool for operations teams (careers)

- Assort Health – genAI-based software for healthcare call center automation (careers)

- Pika – software for home electrification and heating professionals (careers)

- Pave.dev – developer tools to build any fintech app (careers)

- TextBlaze – text expander and communications automation tool (careers)

Series A:

- Flatfile – data import software (careers)

- Middesk – software for business background checks (careers)

- Rundoo – point-of-sale system for building materials vendors (careers)

- Regie AI – content generation platform for go-to-market teams (careers)

- Supermove – vertical software for moving companies (careers)

Growth (series B and beyond):

- Backbone – mobile gaming controller (careers)

- Cribl – IT observability and monitoring (careers)

- Modern Treasury – software tools to enable b2b (business-to-business) payments (careers)

- Remote – payroll software for remote/distributed workforces (careers)

- Upside – deals/discounts mobile app for gas and convenience store purchases (careers)

- Verse Medical – software for durable medical equipment ordering (careers)

Impact:

- Boundless – digitally-enabled immigration services (careers)

- Camus Energy – zero-carbon electric grid orchestration (careers)

- Daffy – modernized donor-advised fund-based giving (careers)

- Folx Health – LGBTQ+-focused virtual health platform (careers)

- Pachama – marketplace for AI-verified carbon offsets (careers)

- ReflexAI – training software for crisis support staff (careers)

- Syndio – products and services to improve pay equity (careers)

Thank you for reading this guide. I truly hope it was helpful and will make the startup path a bit easier for you to navigate. Please let me know if you have any feedback or comments. If I can be of any help, do not hesitate to reach out.